- #Amortization schedule printable full#

- #Amortization schedule printable Offline#

- #Amortization schedule printable plus#

If you opt out, though, you may still receive generic advertising. If you prefer that we do not use this information, you may opt out of online behavioral advertising.

#Amortization schedule printable Offline#

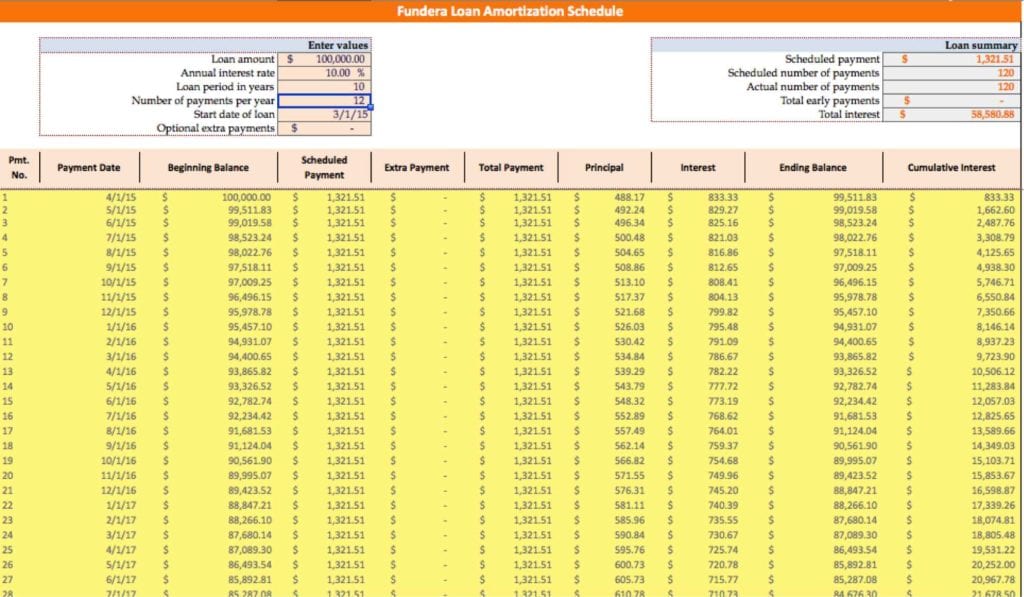

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. Conversely, paying down less than the monthly contractual amount increases the amount outstanding and thus the interest payable ( negative amortization) if the contractual monthly payment stays the same, the number of payments and the term of the loan must increase.We strive to provide you with information about products and services you might find interesting and useful. Paying down more than the monthly contractual amount reduces the amount outstanding and thus the interest that is payable to the lender if the contractual monthly payment stays the same, the number of payments and the term of the loan must decrease. For example, the payment on the above scenario will remain $733.76 regardless of whether the outstanding (unpaid) principal balance is $100,000 or $50,000. Not until payment 257 or over two thirds through the term does the payment allocation towards principal and interest even out and subsequently tip the majority toward the former.įor a fully amortizing loan, with a fixed (i.e., non-variable) interest rate, the payment remains the same throughout the term, regardless of principal balance owed. The exact percentage allocated towards payment of the principal depends on the interest rate.

In the example below, payment 1 allocates about 80-90% of the total payment towards interest and only $67.09 (or 10-20%) toward the principal balance. First, there is substantial disparate allocation of the monthly payments toward the interest, especially during the first 18 years of a 30-year mortgage. There are a few crucial points worth noting when mortgaging a home with an amortized loan.

#Amortization schedule printable plus#

This amortization schedule is based on the following assumptions:įirst, it should be known that rounding errors occur and, depending on how the lender accumulates these errors, the blended payment (principal plus interest) may vary slightly some months to keep these errors from accumulating or, the accumulated errors are adjusted for at the end of each year or at the final loan payment. In addition to breaking down each payment into interest and principal portions, an amortization schedule also indicates interest paid to date, principal paid to date, and the remaining principal balance on each payment date.Īmortization schedule assumptions Often, the last payment will be a slightly different amount than all earlier payments. The last payment completely pays off the remainder of the loan.

#Amortization schedule printable full#

The first payment is assumed to take place one full payment period after the loan was taken out, not on the first day (the origination date) of the loan. Increasing balance ( negative amortization)Īmortization schedules run in chronological order.Balloon (amortization payments and large end payment).There are different methods used to develop an amortization schedule. As the loan matures, larger portions go towards paying down the principal. Initially, a large portion of each payment is devoted to interest. An amortization schedule indicates the specific monetary amount put towards interest, as well as the specific amount put towards the principal balance, with each payment. While a portion of every payment is applied towards both the interest and the principal balance of the loan, the exact amount applied to principal each time varies (with the remainder going to interest).

The schedule differentiates the portion of payment that belongs to interest expense from the portion used to close the gap of a discount or premium from the principal after each payment. The percentage of interest versus principal in each payment is determined in an amortization schedule. A portion of each payment is for interest while the remaining amount is applied towards the principal balance. Amortization refers to the process of paying off a debt (often from a loan or mortgage) over time through regular payments.

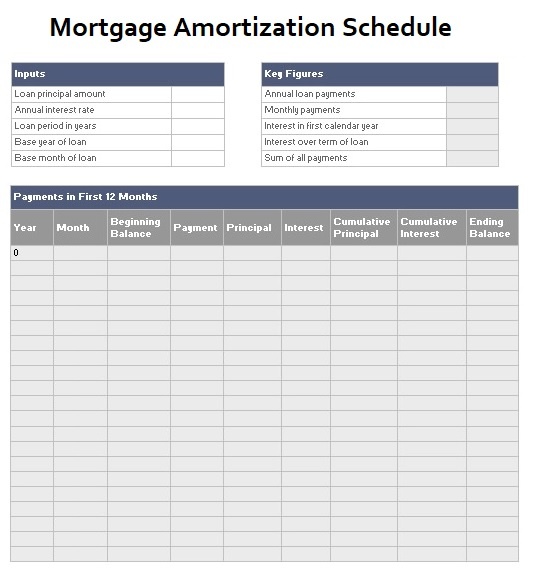

Table detailing each periodic payment on an amortizing loanĪn amortization schedule is a table detailing each periodic payment on an amortizing loan (typically a mortgage), as generated by an amortization calculator.

0 kommentar(er)

0 kommentar(er)